Buy Precious Metals At

Dealer Cost!

Watch our video BELOW TO FIND OUT HOW.

Join us for significant savings on precious metals. As much as 10-20% below what all the big name dealers are charging!

A Great hedge against inflation to preserve your purchasing power.

Why Buy Precious Metals?

Simply Put

If you took a $20 bill into a bank in 1913, you could exchange it for 20 $1 bills, or you could exchange it for a $20 one ounce gold coin. Did you know that?

Stay with me here. You could take a $20 bill into a bank today and exchange it for 20 $1 bills, right? So still you may ask ,"Then what is your point? Nothing has changed, right?"

We're not done yet, please stay awake a few seconds longer and pay attention.

Okay, so now try taking that same $20 bill into a bank and ask them to exchange it for a $20 one ounce gold coin. What do you think will happen? Do you know?

Stated another way. How much was one ounce of gold worth in 1913?

Okay, very good again!

So why is that?

Wrong!

Let me put it like this.

An ounce of gold now is worth exactly what an ounce of gold was worth back in 1913, and that is one ounce of gold. The value of the gold has NOT CHANGED at all.

Now you might be saying "You are crazy, how can you say that? You just told me that you could buy that one ounce of gold in 1913 for $20, but now it takes $2,000 to buy that same exact one ounce, so how can you say that the value of the gold has NOT CHANGED? You are making no sense. Clearly the value of the one ounce gold coin has risen from $20 to $2,000, so you are just crazy."

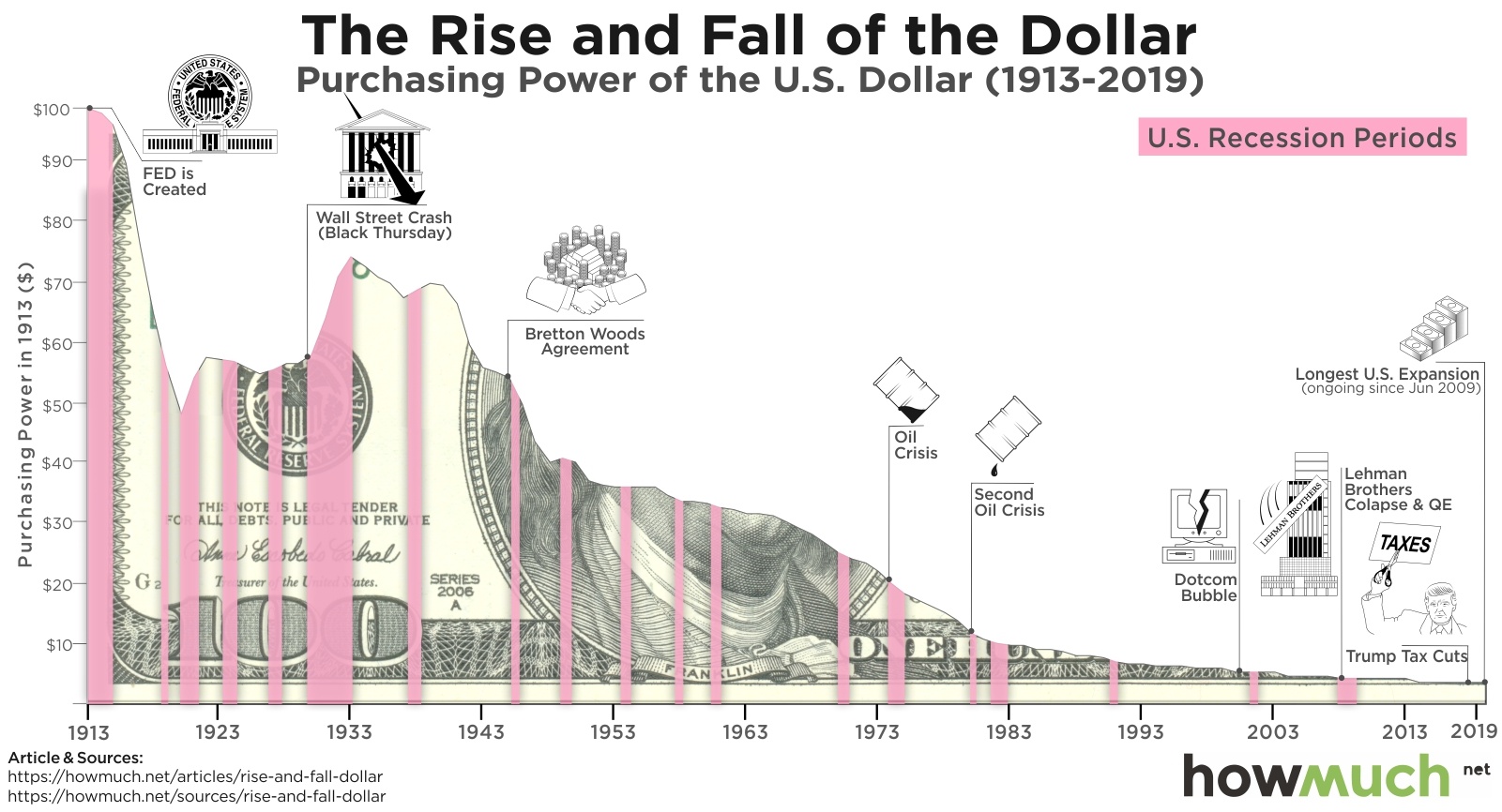

Okay, let's cut to the chase. Carefully review the above chart again, and let it sink in for a few seconds.

Can you see now that it is not the value of the one ounce gold coin that has changed, but it is the value of the $1.00 bill that has changed.

Only it hasn't INCREASED in value, but rather DECREASED!

Got it?!

O, by the way. The reference above to gold "going up in value like real estate"...The same principle is in play here. For instance, if you bought some prime farmland in 1913 for $50 per acre, and today that exact same farmland would go for $5,000 per acre, it's NOT that the value of the farmland has inherently changed. One acre is still worth one acre. But rather, it's that the value, or purchasing power, of the dollar being used to purchase that land has DECREASED! So it takes more of them to buy the same thing.

To add to this, and maybe make it a bit clearer. Let's say a farmer bought 100 acres of farmland in 1913 for the $50 per acre and paid in cash. He would have paid $5,000 for it, right? Ok, now let's say his great grandson were to go out today and buy an adjoining parcel, another 100 acres and he also paid cash for it at a likely $5,000 per acre, or $500,000.

Now here is where it gets really interesting. Stay with me.

Let's say that great grandpa had purchased his 100 acres with gold coins, instead of cash. How many coins would he have used? That's right 250 gold coins (valued at $20 each) equals $5,000. Again, you may ask "What is your point?". It was an option back then. He could use the cash or the gold coin. So where are you going with this?

Hold on. We're almost there. Keep you eyes open just a minute longer, please.

Now, let's say great grandpa was a really forward thinking man and saved up a nest egg to pass on to his children and grand children, and great grand children. Let's say he left $5,000 in cash with instructions that a great grandchild would use it to buy farmland with. So fast forward to today. The great grandchild takes the money that great grandpa passed down in a typical bank account. Today, on average, that $5,000, with interest, would likely have grown to around $160,000 taking bank interest and inflation into account.

NOT BAD! you say. But hold on...

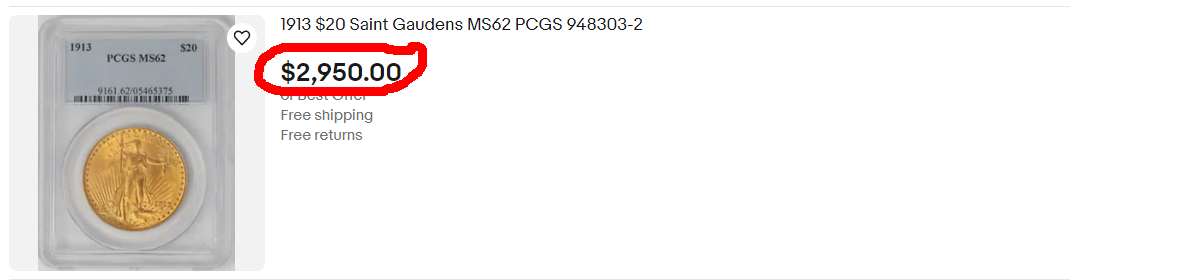

Now, let's say great grandpa had left 250 $20 gold coins to his heirs instead of the $5,000 in cash in a bank account. What would those 250 $20 (face value) gold coins be worth today? 250 coins x $2,000 each = $500,000.

So the great grandson who inherited the cash/savings account could, in theory, take the $160,000 and buy farmland, but at the $5,000 per acre price he could only buy 32 acres. About 1/3 of what great grandpa had bought back in 1913.

But if he had inherited the 250 gold coins instead of the cash, his coins would be worth $500,000, and he could buy the full 100 acres. The same amount of land as great grandpa did over 100 years ago!

Just one other little caveat that could possibly come into play. It's very possible, even likely, that some (perhaps even all) of those coins could, today, be worth far more than the base price for gold coins, due to their "collector" or numismatic value. While this could not be guaranteed, let's look at what an average 1913 $20 "collector grade" gold coin is going for on the market today. And some are going for much more than this, if they have a higher quality grade.

So now that you know why you should buy gold, silver, and other precious metals, the only question that remains is how much do you want to pay?

We have only touched the tip of the iceberg here. Contact us by submitting the above form for more information, or if you're ready to move, then welcome to the club!

Discover the Power of Precious Metals Membership

Experience unmatched benefits and exceptional savings with our exclusive membership program.

Is the membership open to international customers?

Yes, the membership is open to customers worldwide, offering global access to exclusive precious metals pricing.

Are there any additional fees for joining the membership program?

No, there are no hidden fees.

Members enjoy transparent, dealer-cost pricing for all purchases.

How quickly can I start making purchases after signing up?

Upon sign-up completion, you can immediately access our wide range of precious metals products and start benefiting from unbeatable prices.